Smallest banks have

highest growth in assets

Loans to customers surge 59 percent

| Share |

|

|

|

|

|

|

|

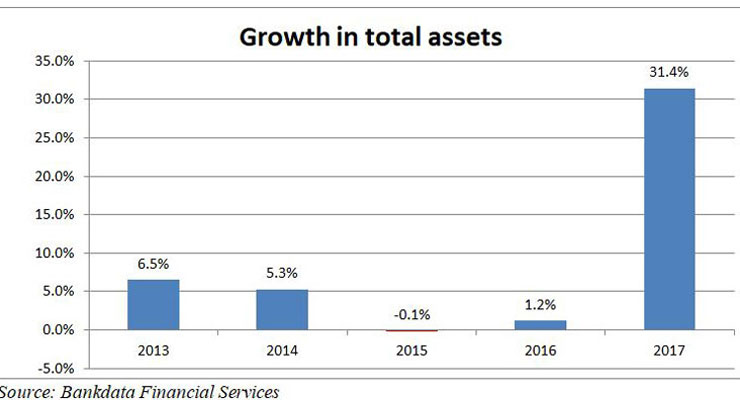

Consolidated assets of the country’s smallest banks soared 31.4 percent year-on-year to $3.19 billion in 2017, mainly driven by a sharp increase in loans, according to Bilanbanques, a report issued by Bankdata Financial Services.

This group of banks, dubbed ‘Delta’, includes 21 banks with deposits of less than $200 million each. Most of them are investment and specialized banks as well as some local subsidiaries of foreign banks.

![]()

Net loans and advances to customers rocketed 59 percent to $1.87 billion. They accounted for 91 percent of the increase in total assets.

Banque de l’Habitat (Housing Bank), whose assets represent more than one-third of the Delta group’s total assets, was the major engine for the growth in assets and loans. The Housing Bank’s total assets jumped 25.2 percent. Its net loans and advances to customers, which account for half of the group’s loans, soared by 38.5 percent.

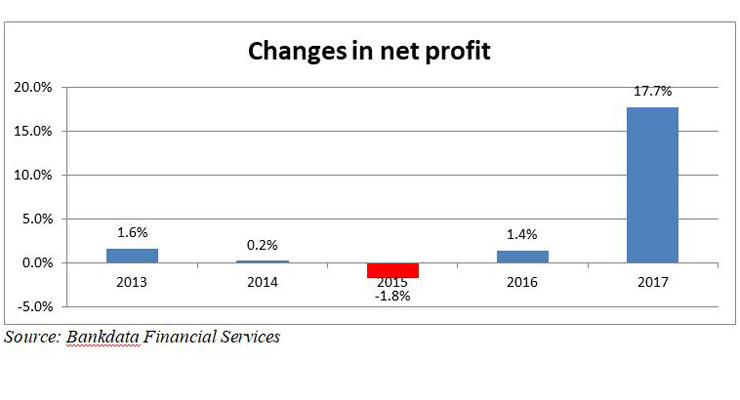

The Delta group saw its combined net profits jump 17.7 percent last year to $37.3 million on the back of a surge in interest income.

![]()

Net interest income, accounting for two thirds of the banks’ total operating income, soared 42 percent to $96.6 million. The Delta banks have reported the highest interest margin of 3.87 percent among all categories of banks. They also boast the lowest cost-to-income ratio.

The Delta group’s total operating income surged 30.6 percent while the Alpha and Beta groups, which include the largest and second largest banks respectively, witnessed a decline in their total operating incomes. Total operating income for the third largest banks—the Gamma group—increased just 4.8 percent.

The Delta banks’ net primary liquidity to deposits ratio was negative at the end of 2017 as they hold a significantly large amount of government paper, according to Bilanbanques. The group has the highest sovereign exposure in the Lebanese currency, with a ratio of treasury bills to deposits in lira of 58.8 percent. It has the lowest dollarization rates of deposits and loans of 63.4 percent and 21.8 percent respectively.

The Delta group has the least exposure to the Central Bank (BDL) with its placements at BDL accounting for 11.9 percent of its asset base. The group’s cash and balances with BDL rose 15 percent to $379 million last year.

Delta banks recorded a capital adequacy ratio, per Basel II requirements, of 28.39 percent which is by far the highest among all groups.

Although smaller banks are in general the best provisioned against doubtful loans, the Delta group’s loan loss reserves accounted for 63.9 percent of doubtful loans, which is the lowest ratio among all groups.

Banking activity in Lebanon remains highly concentrated, with the largest banks holding 90.3 percent of the sector’s total assets, while the Delta group’s assets represent just 1.2 percent of the total.

Besides the Housing Bank, the Delta group includes banks such as FFA Private Bank, Blominvest Bank, Libank, and Qatar National Bank-Lebanon.

Reported by Shikrallah Nakhoul

Date Posted: Oct 25, 2018

| Share |

|

|

|

|

|

|

|