Lira-dollar margin widens

by 1.15 to three percent

Interest rates difference widest since 2005

| Share |

|

|

|

|

|

|

|

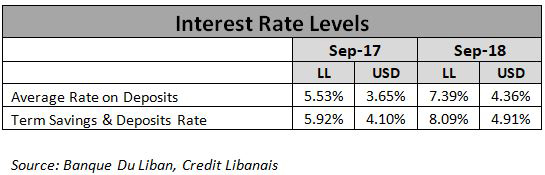

The margin between the weighted average interest rate on lira deposits and that paid on dollar deposits widened by 1.15 percentage points to 3.03 percent in September, compared with a year earlier.

The margin paid on lira deposits vis-à-vis dollar deposits averaged 2.44 percent since 2011, according to the ‘Lebanon Economic Monitor’ report recently issued by The World Bank (WB).

The weighted average interest rate on lira deposits increased by 1.86 percent over the period of September 2017 to September 2018, while the corresponding rate on dollar deposits rose by 0.71 percent.

![]()

The sharp rise in interest rates on lira deposits mainly resulted from the intervention of the Central Bank (BDL) following the temporary and controversial resignation of Prime Minister Saad Hariri in November 2017. According to the WB report ‘De-Risking Lebanon’, one of the measures taken by BDL to support the national currency and the financial system was to encourage “banks to offer enticing rates for longer maturity deposits”.

“Worried depositors who inquired with banks about their holdings, or who went to banks with intentions of dollarization or even withdrawal, were offered very enticing interest rates for longer maturity,” said the WB. The weighted average rates on lira and dollar deposits witnessed from October 2017 to December 2017 the sharpest surge since the assassination of former PM Rafic Hariri in 2005, according to the report.

Reported by Shikrallah Nakhoul

Date Posted: Nov 06, 2018

| Share |

|

|

|

|

|

|

|