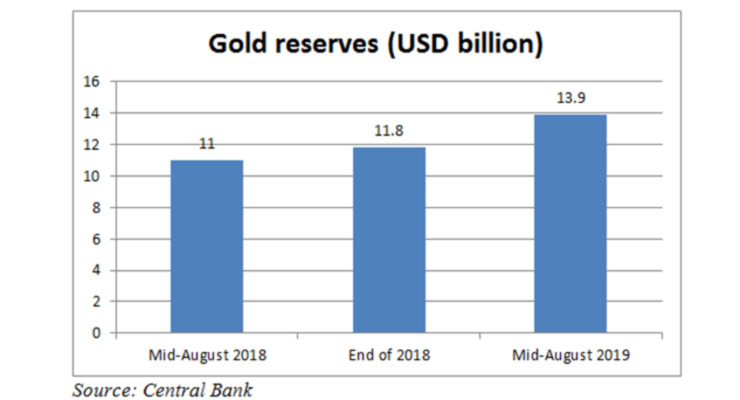

Central Bank’s gold reserves

jump 26 percent in 12 months

Improvement driven by surge in global prices

| Share |

|

|

|

|

|

|

|

The value of the gold reserves held by the Central Bank (BDL) surged 26 percent to $13.9 billion by mid-August 2019 compared with a year earlier driven by a sharp rise in global gold prices, according to BDL data.

The spot price of an ounce of gold jumped to $1,520.40 on August 15, from $1,178.3 a year earlier, according to the London Metal Exchange. The price increased further to reach $1,521.20 on August 30. This raises the value of BDL’s gold reserves to $14 billion.

The improvement in the value of BDL’s gold reserves over the 12-month period ending on August 15 was $2.9 billion, which is not enough to offset BDL’s decline in foreign assets. According to the Central Bank’s interim balance sheet, foreign assets, excluding gold, decreased by $6.5 billion over the same period.

According to a recent credit rating report by Fitch Ratings, the fact that BDL’s foreign assets (excluding gold) are largely liquid alleviates the burden of its sizeable foreign currency liabilities towards local banks. These liabilities have much longer average maturities than BDL’s foreign assets. They are estimated by Fitch at $62 billion in June (of which $19 billion are mandatory reserve requirements).

BDL’s gold reserves consist of 9.22 million ounces that it cannot sell unless it is authorized to do so by a legislative text enacted by the Parliament.

Lebanon ranks second in the world in terms of gold reserves per capita which amount to 69.3 grams. Switzerland tops the list with 136.3 grams per capita.

Reported by Shikrallah Nakhoul

Date Posted: Sep 02, 2019

| Share |

|

|

|

|

|

|

|