$1.3 billion in subscriptions to investment funds in 2018

| Share |

|

|

|

|

|

|

|

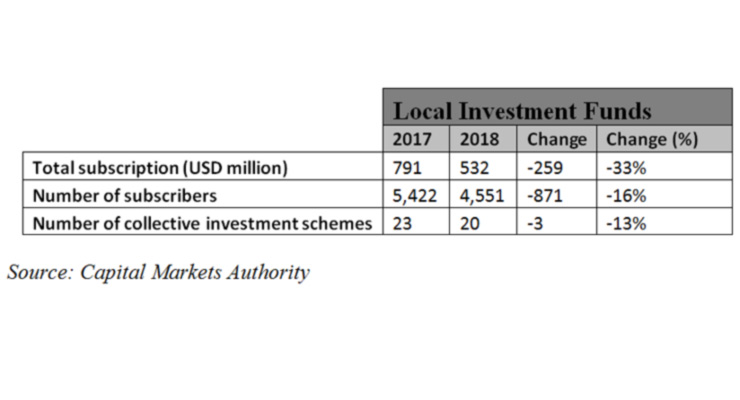

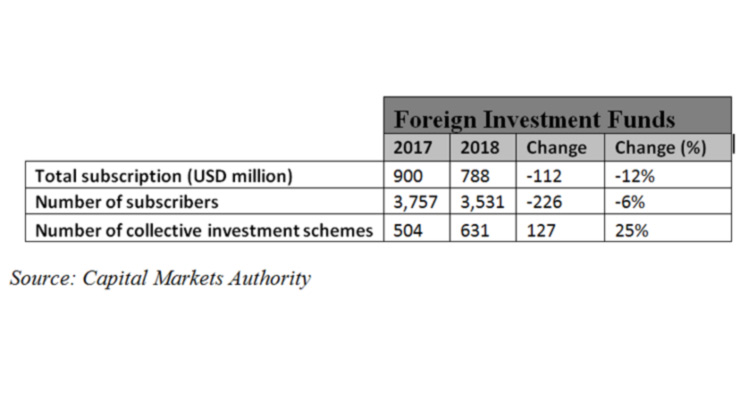

Subscriptions to local and foreign investment funds dropped by $371 million, or 22 percent, to $1.32 billion in 2018 compared with the previous year, according to the Annual Report of the Capital Markets Authority (CMA).

The number of subscribers fell by 12 percent, to around 8,100 subscribers.

The number of the funds, also known as collective investment schemes (CISs), increased 24 percent, to 651 CISs.

Subscriptions to local funds plunged by $259 million, or 33 percent, to $532 million. The number of subscribers fell by nearly 870, or 16 percent, to around 4,600 subscribers. Out of a total of 20 local CISs, 13 invest in the Middle East region, three invest in Lebanon, one in the United States, and three funds invest in other countries.

Subscriptions to foreign CISs dropped 12 percent, to $788 million. The number of subscribers decreased six percent, to around 3,500.

Jean Hanna, Deputy General Manager at the specialized bank Fidus, said that when interest rates are high, investors prefer to place their money in deposits, especially as they are less risky than investment funds and structured products. Likewise, deposits are more liquid than funds and investing in the form of deposits could be for a relatively short period of time, he said. When investors expect the upward trend in interest rates to continue, they deposit their money with banks for the short term as they look forward to higher rates, according to Hanna.

Reported by Shikrallah Nakhoul

Date Posted: Sep 04, 2019

| Share |

|

|

|

|

|

|

|