Insider trading suspected of

motivating Eurobond default

Up to ten times the potential gain

| Share |

|

|

|

|

|

|

|

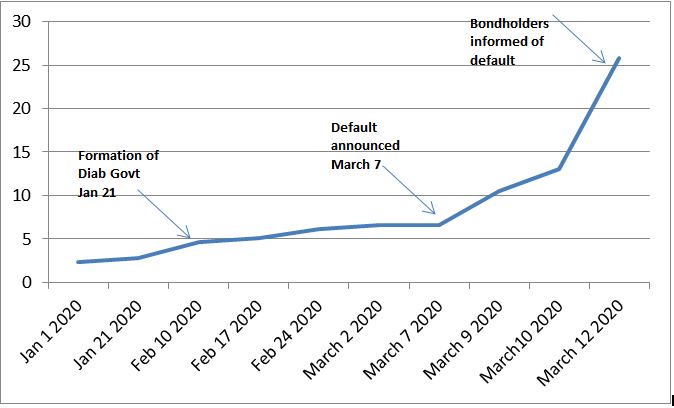

Prices of Credit Default Swaps (CDS) sharply and suspiciously increased between January and March 2020 prior to the decision of defaulting on the Lebanese Eurobonds became public. Recently published information is pointing to insider trading and price manipulation.

According to an article by Nicolas Sbeih published by Ici Beyrouth news website, someone who would have bought a CDS in early January of that year, when the option of default on Eurobonds was not public knowledge would have earned ten times the value of that investment by the time the information was announced. At the beginning of January 2020, a CDS was trading at $2,285. it catapulted to over $25,000 on March 12 when the government officially announced suspension of payment (a.k.a. default) and informed bondholders of the matter (Click here for prices of Lebanon’s five-year bond CDS).

In March 2020, a payment of close to $400 million was ruled in favor of investors holding credit insurance on Lebanon’s Eurobonds according to a binding decision from a CDS committee (see BusinessNewsstory).

The Ici Beyrouth article cites financial sources that believe that CDS holders were not only aware of the envisaged default but were also actively involved in the decision. They would be influential enough to tip the balance in the direction of default, motivated not by the inability of the State to honor its debt, or by any concern for the subsistence of the people, but to reap the profits from the resale of the CDS they were holding.

Prior to the publishing of the article, Riad Salameh, Governor of the Central Bank (BDL), disclosed in an interview with the same website, and subsequently on the LBCI television channel, that BDL is carrying out an investigation to find out if there has been insider trading linked to the default on public debt, for illicit gain purposes.

A CDS is a credit insurance policy hedging against a potential default of the underlying security, such as a Eurobond issued by the Lebanese government. These policies are most often issued by large banks or insurance companies that guarantee the underlying debt between the issuer and the buyer. Its pricing is directly linked to the credit rating of the insured instrument. Once issued, a CDS becomes a tradable financial instrument. A CDS holder who believes that the risk of default is lower than the market value of the CDS will probably sell it to someone who believes the opposite. Like other financial securities such as stocks and bonds, CDSs are traded freely in successive transactions between buyers and sellers, while their prices fluctuate according to the changes in perceived risks. The greater the perceived risk of default, the more expensive this CDS insurance will become.

To support this conjecture, the article’s sources highlight that BDL was well able at the time to rescue the State. Its foreign currency reserves were around $30 billion.

The Eurobonds maturing in 2020, with accrued interests, had a redemption value of $4.6 billion. Those due in 2021 were of the same amount, i.e. around $9 billion over two years. This would have allowed giving sufficient time in principle to the State to start cleaning up its finances. More than half of the Eurobonds were held by local entities (BDL, banks, insurance companies), which could have been amenable to a rescheduling of the debt principal. The State (or BDL) would therefore have to pay much less than half the due amounts.

Date Posted: Jun 27, 2022

| Share |

|

|

|

|

|

|

|