Remittance inflows

rise to $8 billion

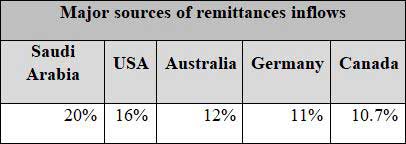

Saudi Arabia remains the top source at 20 percent of the total. USA ranks second

| Share |

|

|

|

|

|

|

|

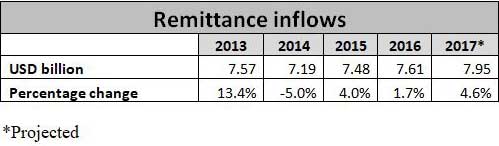

Remittance inflows are estimated to have risen 4.6 percent in 2017 to $7.95 billion, according to the World Bank’s Migration and Development Brief released in April.

Remittances account for 15 percent of GDP, the second highest ratio among major remittance receiving countries in the Middle East and North Africa (MENA) region.

The increase in remittance inflows represents an improvement from the 1.7 percent growth recorded in 2016.

Economist Samir Nasr, Chairman of ECE Capital, said the improvement was mainly driven by the rise in interest rates on the local market in 2017 which is attracting more capital. “This trend is likely to continue next year,” he said. According to Nasr, expatriates living in the Gulf region are encouraged to send more remittances despite the fact that their income may not have increased due to the economic conditions in their host countries.

The remittance growth rate in MENA region was double Lebanon’s performance, at 9.3 percent.

According to the World Bank’s forecast, a pickup in growth in the GCC countries is expected from 2018 on, due to a more relaxed fiscal stance, more infrastructure investments, and reforms to promote non-oil private sector growth.

Remittance outflows, however, will be dampened by Saudi nationalization policies which forbid employing foreign workers in some sectors starting from 2018.

The cost of sending money from countries in the Organization for Economic Co-operation and Development (OECD) to Lebanon continues to be very high, in the double digit level, according to the report.

![]()

![]()

Reported by Shikrallah Nakhoul

Date Posted: May 04, 2018

| Share |

|

|

|

|

|

|

|