2020 draft budget

is ready for debate

Proposed deficit is at 5.7 percent of GDP

| Share |

|

|

|

|

|

|

|

The Ministry of Finance (MoF) has submitted the draft law of the 2020 budget to the Cabinet with a projected deficit of LL5,090 billion ($3.4 billion). It is expected to be discussed over several sessions and after a vote is sent to Parliament sometime during October.

The deficit figure does not include Treasury transfers to Electricité du Liban (EDL), which are set at LL1,500 billion ($1 billion).

The deficit-to-GDP ratio is estimated at 5.7 percent compared with 7.6 percent in the 2019 budget law that was approved by the Parliament. If transfers to EDL are added to the deficit, the 2020 deficit-to-GDP ratio becomes 7.4 percent.

The 2020 deficit is $509 million more than that of 2019. The projected real economic growth of 1.2 percent in 2020 made the deficit-to-GDP ratio for 2020 lower than that of 2019. The MoF anticipates a GDP of $59.2 billion for next year. It has projected an inflation rate of 2.8 percent.

The MoF said the draft law includes budget cuts of more than $1.7 billion. The expenditure items set to witness significant increases in 2020 are interest expenses as well as retirement pensions and compensation following lay-offs. Interest expenses on Treasury bills, Eurobonds, and loans will rise by $585 million. Overall debt service is expected to reach $6.1 billion in 2020. Retirement pensions and lay-off compensation will increase by $201 million.

Salaries, wages and social benefits together with debt service continue to account for the biggest chunk of overall public spending. This represents 79 percent of the total in the 2020 budget.

Total expenditure is projected at $16 billion, most of which consists of current spending, which totals $15.1 billion. Investment expenditure is projected at just $930 million.

Total revenues are estimated at $12.6 billion. They consist of tax revenues of $10 billion and non-tax revenues of $2.6 billion.

In the new draft budget the MoF has proposed to exempt education institutions licensed by the Ministry of Education and Higher Education and that belong to nonprofit organizations or to recognized religious sects from income tax. Under the existing law, all education institutions are exempt from income tax. Nonprofit bodies and associations that are engaged in educational activities and that were not established through a government decree will be given one year to obtain such a decree.

Imported raw materials used directly in the production of pharmaceutical products will be exempted from value added tax (VAT).

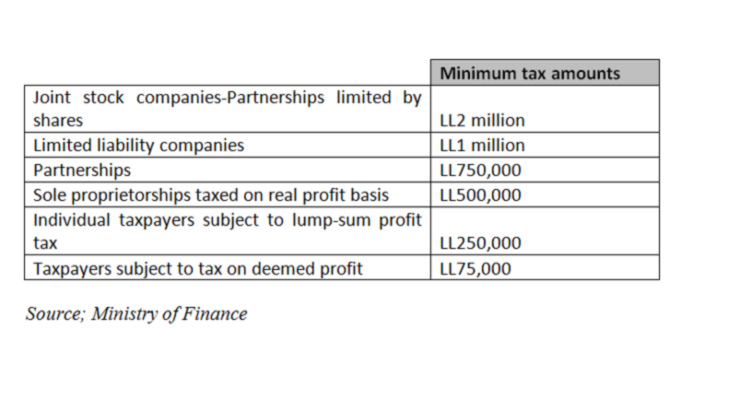

The draft law has set minimum amounts for income tax on companies and businesses. After the calculation of the tax, if the amount is below the minimum, the taxpayer must pay the minimum amount.

Reported by Shikrallah Nakhoul

Date Posted: Sep 17, 2019

| Share |

|

|

|

|

|

|

|