Fruit juice industry

stands at $150 million

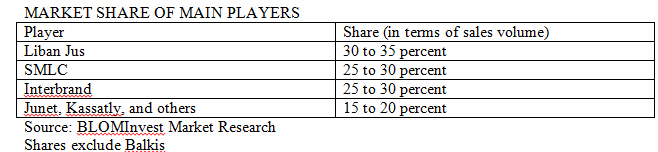

Three main players dominate the market

| Share |

|

|

|

|

|

|

|

The size of the fruit juice industry ranges between $130 and $150 million, according to a recent study by BLOMInvest, “Can fruit juices keep the doctor away?”

One liter of juice costs on average $1.20 which translates into a volume for the juice market in the range of 108 to 125 million liters.

There are three main players, in addition to other producers and a niche market player. They are Liban Jus, SMLC (the agent of Pepsico), and Interbrand. Other players include Junet Juice, Kassatly Chtaura, Cedar’s, Liban Lait, Super Jus Chtaura, Rawabi, and Paradice.

The niche market player, Balkis, has different manufacturing techniques and uses different raw materials. The company targets consumers who prefer juices made from fresh fruits rather than from concentrates.

Producers of fruit juices are very competitive and tend to differentiate themselves by relying mainly on branding. Libby’s, Tropicana, and Candia are brands produced ‘under license’, which means that their sales could be boosted because of the reputation of the multinational companies they represent.

Others rely on the strength of their distribution channels and points of sale. Ralph Chartouni, Sales, Marketing and Logistics Manager of Interbrand, said “Fruit juices tend to be consumed on-the-go, which makes small retailers as well as groceries in remote areas our main target clients.”

Fruit juices come in three types: Premium, mainstream, and affordable. For example, Liban Jus offers three brands: Maccaw (premium), Uno (mainstream) and Top Juice (affordable).

Other producers like Kassatly and Junet, limit their provision to one juice brand. Kassatly, for example, manufactures Fruitastic.

Juice producers import around $5.9 million worth of pineapple and orange concentrates alone. According to Customs, around 4,800 tons of fruit juices worth $8.7 million were imported in 2017, of which 34 percent were pineapple concentrate, and 13 percent were mixed fruit concentrate.

Only $2.2 million worth of juice is exported, mainly to Arab and African countries. Qatar is the number one importer, with 28 percent of the total.

Chartouni said: “The main trends that impact local industries propagate to the country mainly from Europe. Therefore, the two strong trends of healthier choices and lower calorie foods will probably shape the direction of the juice industry in the coming years.”

![]()

Reported by Yassmine Alieh

Date Posted: Mar 12, 2018

| Share |

|

|

|

|

|

|

|