BDL creates legal framework

for e-payment service providers

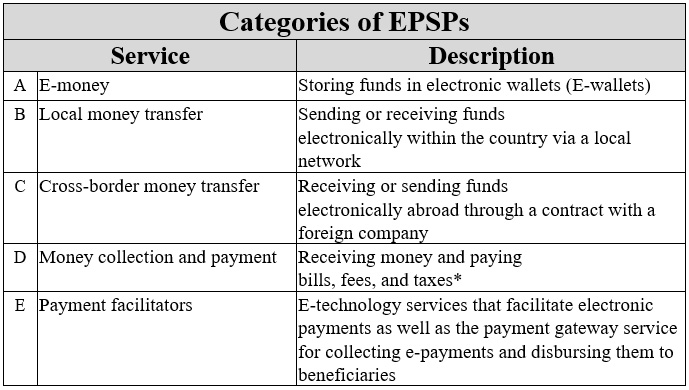

Classified for the first time by category

| Share |

|

|

|

|

|

|

|

The Central Bank (BDL) has issued a circular to regulate and classify electronic payment service providers (EPSPs) in order to enhance compliance and protect users. It said that it is the first time in Lebanon that EPSPs are classified into categories according to the types of services they provide.

*Such as education tuitions and fees paid to syndicates, bills paid to mobile and landline telephone companies, and commercial institutions in addition to taxes and fees paid to ministries, public institutions, and public administrations

Source: Central Bank

The minimum capital of an EPSP, with the exception of payment facilitators, is set at LL50 billion. The dollar equivalent of the capital must not be less than its value at the current exchange rate ($558,660). The minimum capital of a payment facilitator is set at LL25 billion ($279,330). The capital requirements are cumulative according to the number of categories of services provided by each EPSP. A sum representing 15 percent of the total capital required by each EPSP must be frozen at BDL and will not be returned except when the EPSP liquidates its business.

An EPSP providing services under any of the A, B, C, and D categories is not allowed to contract with agents in a specific governorate, unless it has already opened at least one branch there and so long as the number of agents per branch does not exceed 30 agents. Their total number across all governorates must not exceed 1,200 agents. “Each branch shall be responsible for controlling and monitoring the activities of its affiliated agents,” BDL said.

Institutions providing services under categories A, B, and C, are allowed to install ATMs for the deposit and withdrawal of funds after obtaining BDL’s prior approval.

The Central Bank said it will issue a list of already licensed EPSPs and that it has suspended licensing requests for categories A, B, C, and D until further notice.

“[Each] institution must establish a compliance unit or appoint a compliance officer, depending on the size and nature of its business. This unit must be independent from the institution’s daily operations, reporting administratively to the general manager, and communicating directly with the board of directors,” BDL said.

Date Posted: Jan 20, 2026

| Share |

|

|

|

|

|

|

|